Question: Two weeks ago you wrote a column stating that the average sale price growth in Arlington was 0.15%, but the County just announced that the average tax assessment will increase by 2.9%, why the difference and is there anything I can do to challenge my assessment if I think it’s too high?

Answer: The numbers I used two weeks ago in my 2016 market review were based on the average sold price (less any seller credits) for all on-market homes sold in Arlington in 2016. While the County does factor in recent sales, they use a different model for calculating the tax assessment that includes lot size, taxable square footage, permit history (major updated/additions) and other factors. The County’s approach is localized by neighborhood rather than across the entire county and they use data from Sept 1-August 31. For example, your 2016 assessment is based on market data from Sept 1, 2015-August 31, 2016.

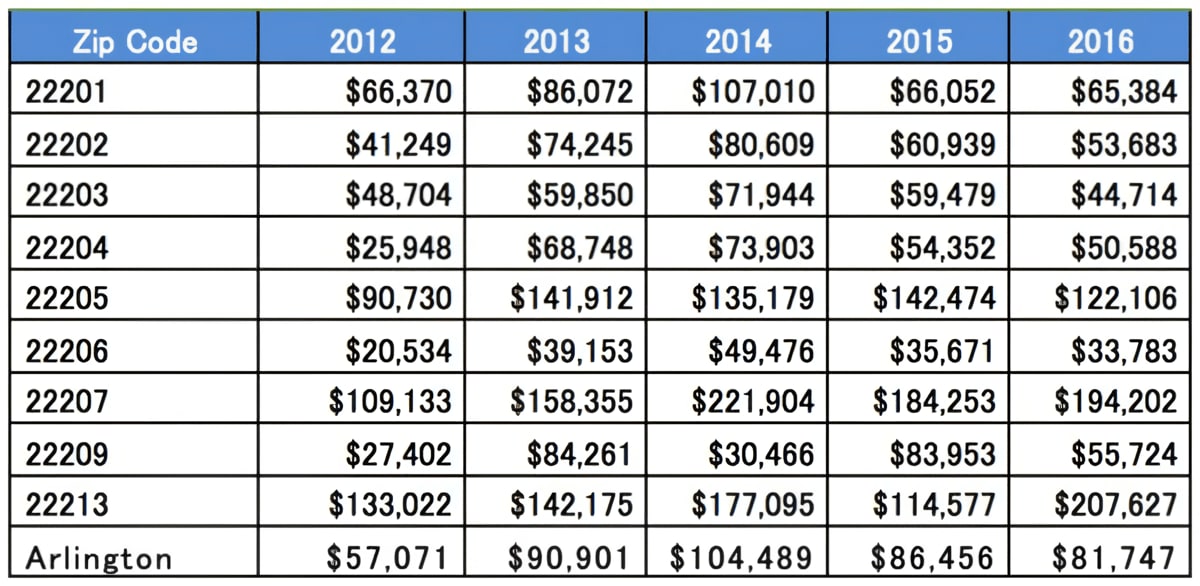

Overall, Arlington homeowners get a pretty good deal on their tax assessments from the County. In 2016, the average home in Arlington sold for almost $85,000 more than its 2015 tax assessment. At a tax rate of .991%, that’s about a $850 “savings.” Here’s a look at the average difference in sold price vs the previous year’s tax assessment value in Arlington over the last five years, broken out by zip code:

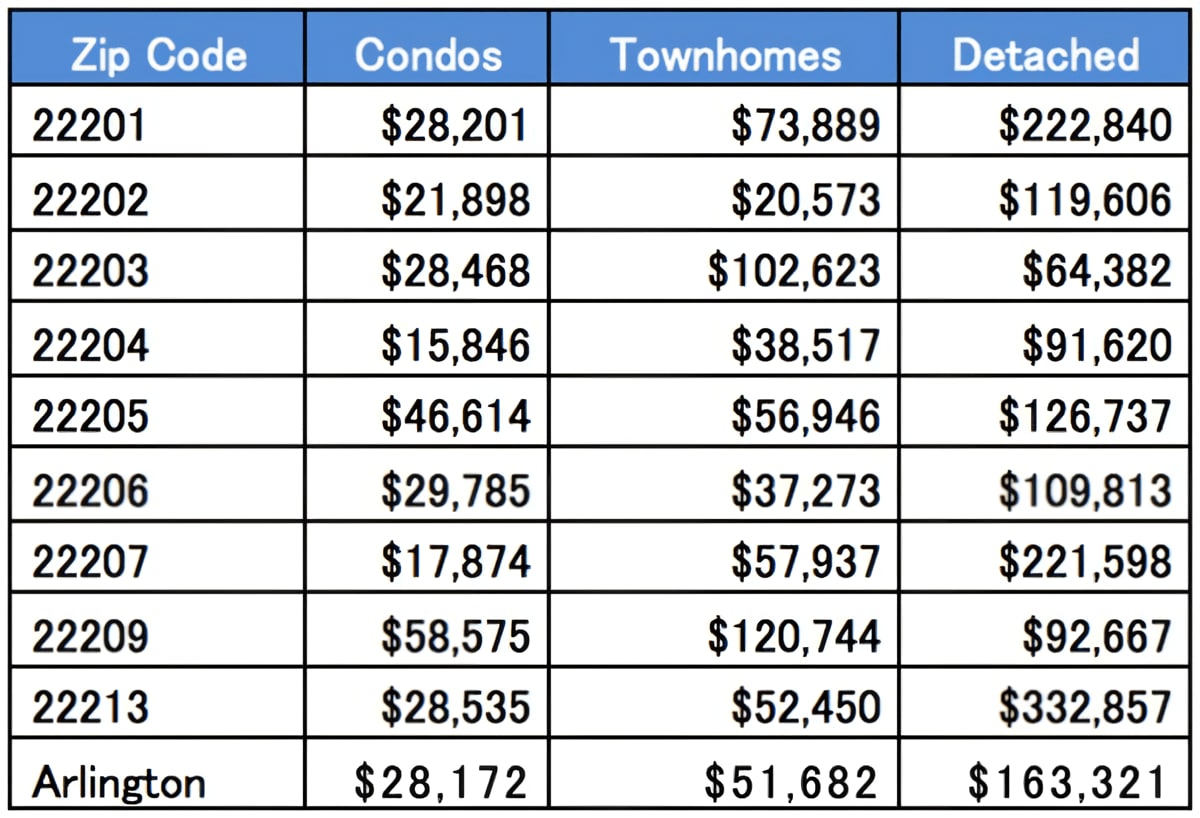

Here’s the average difference between 2016 sale prices and their 2015 assessed values, broken out by the three major types of housing in Arlington:

Note that for both tables above, I removed any sales where the tax record didn’t include an assessed value (about 5% of sales records).

In 2016, Arlingtonians will pay .991% of their assessed value in real estate taxes. Every year you have an opportunity to appeal your assessment and yes, it has worked, but the burden of proof is on the homeowner, not the County. Arlington provides an informative website on the appeal process.

Quick hits on the appeal process:

- Expect to receive your 2016 assessed value in later this month

- Your first appeal with the Dept of Real Estate Assessments must be filed by March 2, 2016

- Step 1: Call 703-228-3920 for information on how your assessment was determined

- Step 2: File your appeal online here (First Level)

- Step 3: An assessor will visit your home and you can provide relevant info to make your case

- Step 4: If you’re not satisfied with the decision or have not received written notice by April 1, file your second appeal with the Board of Equalization online here (Second Level) by April 15

- Step 5: If you’re not satisfied with the decision, your final option for appeal is with the Circuit Court, which will likely require you to hire an attorney

If you’re considering appealing your tax assessment, feel free to reach out to me to discuss building a case. I have access to micro and macro market data that can help you determine if your property is over-assessed and can help you create a clear report supporting your appeal.