Question: As interest rates have increased over the last 6-12 months, how will the market react to higher rates and do you expect them to come back down in 2018?

Answer: The rates I’m seeing today are about 1-1.5% higher than what I’ve seen on average over the last few years and about .5% higher than where they’ve been over the last 6-12 months. Generally, most economists are projecting growth in the US and there are similar signs in Europe so if that holds, expect interest rates to continue their upward trajectory.

Higher Mortgage Rates In 2018

According to Freddie Mac, the average Mortgage rate from the 1970s-2000 was about 7%, the average rate from 2000-2008 was 6% and we’ve been hovering around 3.5-4% since 2008. Freddie Mac currently predicts that rates will reach about 5% by the end of 2018.

-

Mortgage rates are at the mercy of the US and global economies so predicting their direction is no different than predicting how the stock market will do.

-

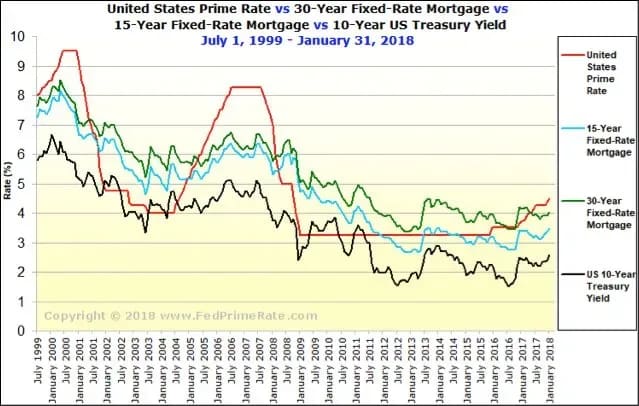

Contrary to popular belief, mortgage rates are not directly correlated to the Fed rate that you regularly hear about in the news. So when you hear that the Fed is planning to increase rates by .25%, that does not mean your mortgage rate will be .25% higher the following day. See the chart below for historical trends of Fed rate vs mortgage rates:

-

We are currently experiencing high daily and weekly volatility in mortgage rates, which is frustrating for many. Some weeks see swings of .25% so you can either benefit or lose out from those swings based on when you lock your rate. Discuss this risk with your loan officer.

-

You may have missed the lowest rates over the last few years, but historically mortgage rates are still well below average as you can see from the chart below from Freddie Mac:

The Impact Of Higher Rates

For my clients, the ones who feel the rates increase the most are those who have been in the market for 6-12 months but have not purchased yet either due to lack of suitable inventory or urgency.

It’s tough to accept that rates were about 1% lower when they started looking and now they feel like they’ve lost. Those who are just now entering the market tend to be much better at brushing it off. It also impacts my clients who are not selling a home because those who are selling will realize the benefits of the stronger market vs those who are just buying are at its mercy.

First-time buyers are also more sensitive to rate fluctuations because most are already struggling to adjust to the hefty price tag of buying what they want in the DC Metro area.

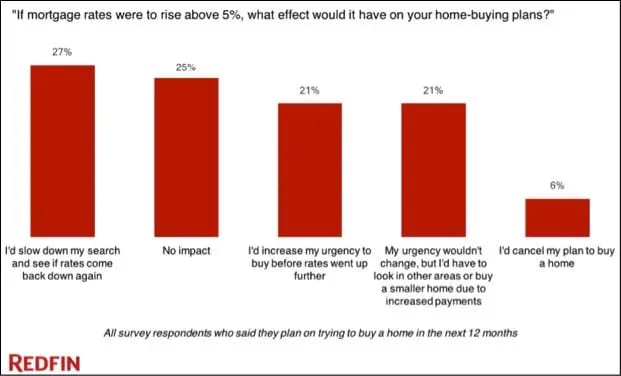

Redfin recently asked 4,000 buyers who planned to purchase in the next 12 months how increasing rates would impact their purchase and found that only 6% would cancel their plans to buy while nearly 50% wouldn’t change anything or would increase their urgency to buy.

This might seem like a good result for homeowners, but losing 6% of buyers, having 21% reduce their budget, and 27% waiting for rates to drop is a bad sign. Especially if rates continue to go up and the 27% who were waiting for rates to drop decide to either stop their search or reduce their budget.

I think the biggest reason increasing rates will slow the market is the psychological effect of higher rates vs the actual impact on buyers’ budgets. For buyers struggling to internalize the “loss” they’ve taken now that rates are higher, consider the following:

-

On a $400,000 loan, a .25% increase in rate represents $60/month. Try to decide if a $50-$150 change in your monthly mortgage cost is worth giving up on a home purchase or compromising on what you want/need. Most buyers decide to spend less than what they’re approved for, so there is usually some cushion.

-

The reason rates are higher is because the economy/stock market has done so well lately so your investments and/or income are hopefully increasing at a rate on pace with or above what you’re giving up in increased mortgage rates.

-

In 2017 the S&P 500 returned about 20% to investors so maybe you earned enough in the market to allow for a higher down payment?

Hopefully, the net effect of everything that factors into mortgage rates is still positive for you.

With so much volatility around mortgage rates, it’s even more important that your lender be able to advise instead of just being a pass-through for today’s rates.

My clients have found Jake Ryon of First Home Mortgage ([email protected]) and Troy Toureau of McLean Mortgage ([email protected]) to be valuable resources during their home purchases and I’d encourage anybody to reach out for advice.