Question: I have heard that inventory is building and the market is starting to favor buyers, is that accurate?

Answer: I have preached for years the importance of caution and care when applying real estate data to your own decision-making. National real estate data is rarely useful, regional real estate data is sometimes useful, and even local data can be full of misleading conclusions.

It’s quite likely you’ve started to hear news and see data showing significant inventory build-up and markets shifting to favor buyers. We have seen modest market shifts in Northern VA, but nothing like what other regions of the country are experiencing, which is the source of most of the newsworthy reports you may see.

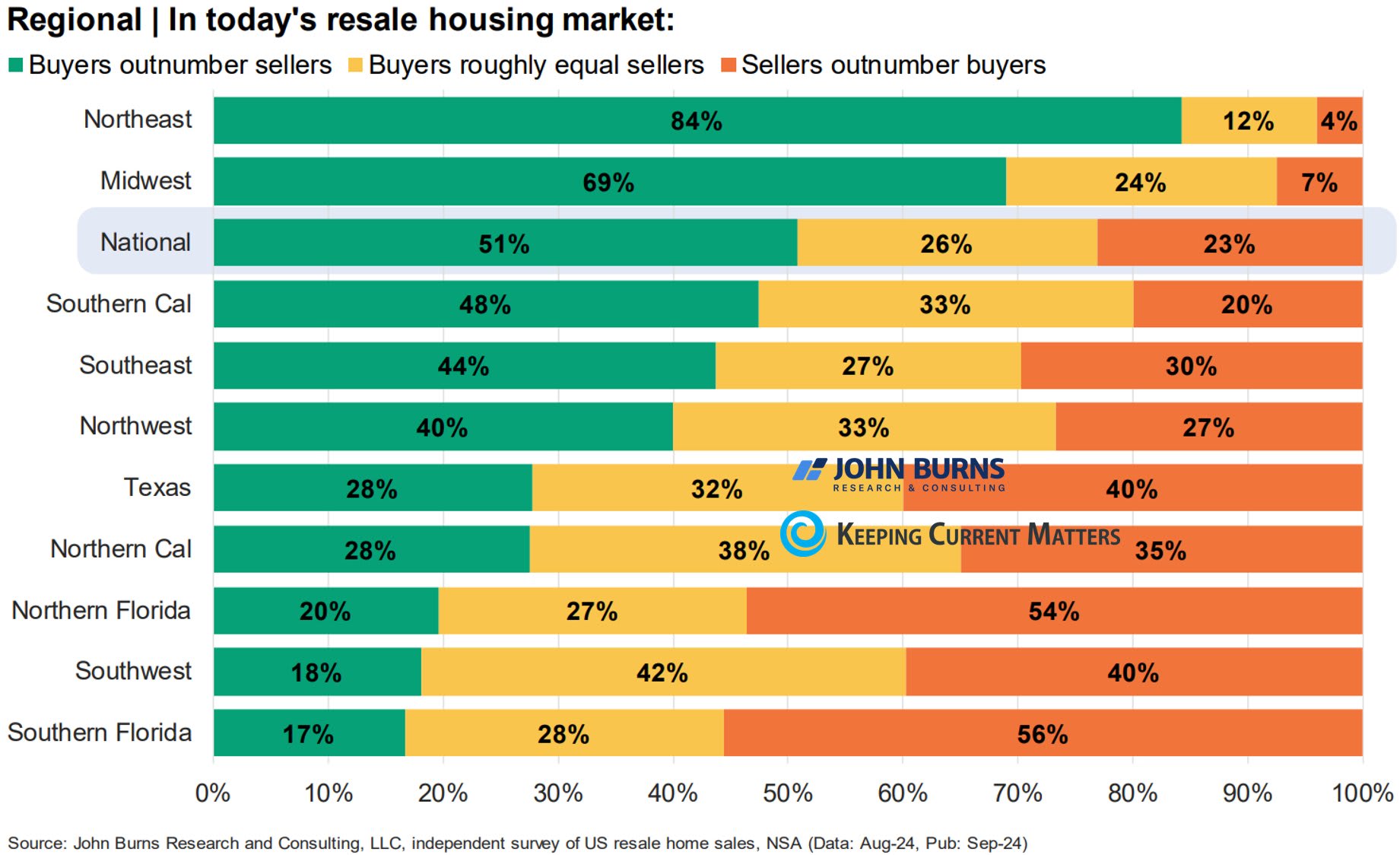

I recently came across this fantastic chart illustrating how different housing market conditions are in different regions of the country. The bigger the green bar, the more favorable the market is for sellers, the smaller it is, the more favorable the market is for buyers.

Inventory Levels and Demand Drive Price Momentum

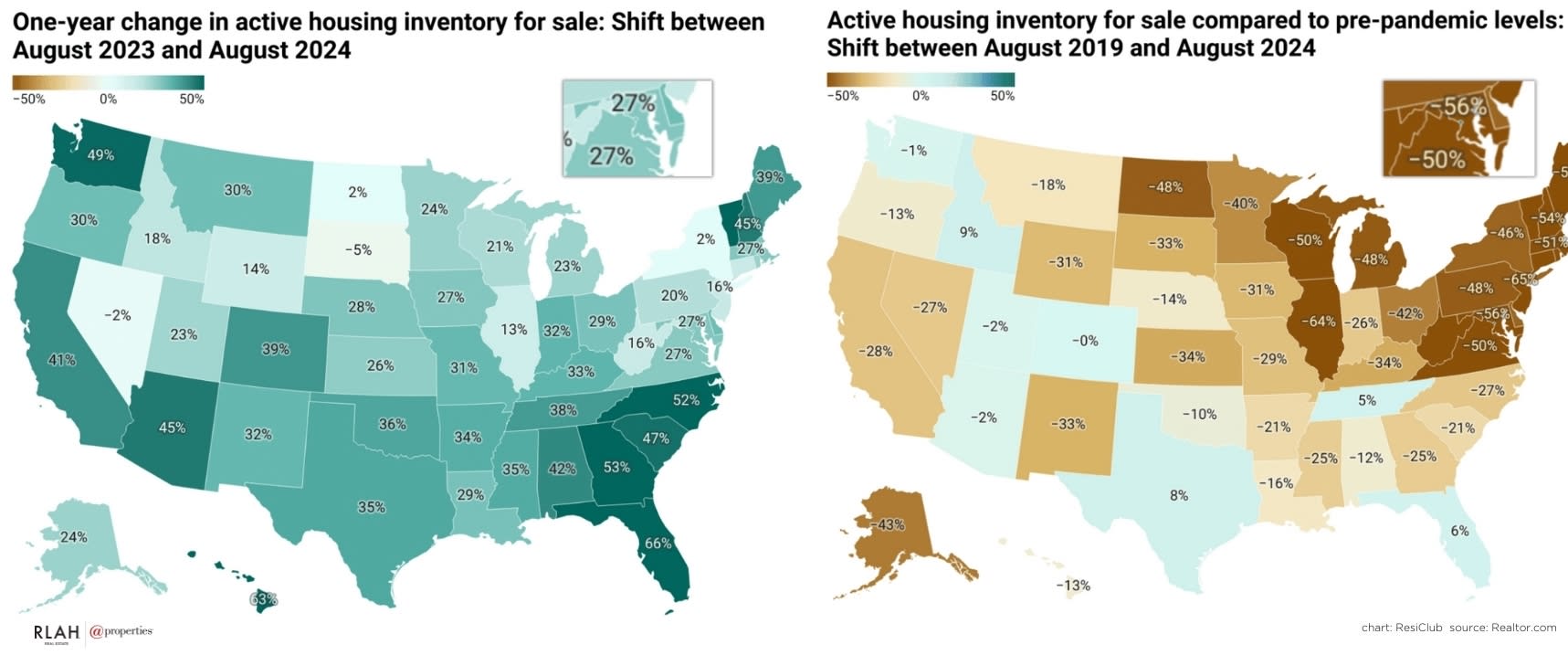

The green bars above illustrate demand levels against inventory and provide a good indication of how prices might react in the coming months/year, the charts below show how inventory levels have

changed by state over the past 12 months and five years (pre-pandemic levels) and are also a good indicator of future price movement.

- Sun Belt and Mountain West markets are seeing a faster return to pre-pandemic inventory

levels - Many of the markets seeing the biggest buyer-favorable swings (more inventory) saw greater

home price growth during the pandemic housing boom - Northeast and Midwest markets have lower levels of homebuilding (new supply)

It’s Good to be in the DMV

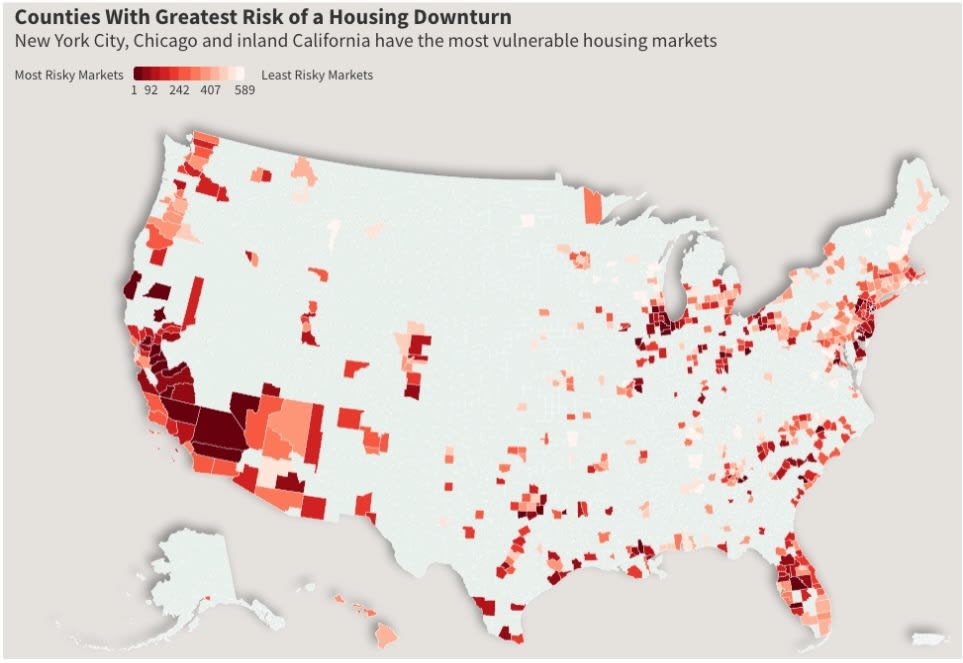

Attom Data released a report on Sept. 6th analyzing 589 counties to determine risk of a housing downturn based on:

- % of homes facing possible foreclosure

- underwater mortgages

- % of income to buy

- median sales price

- local unemployment rates

The metropolitan areas around New York, NY, Chicago, IL, as well as broad stretches of California, the Southwest, and Florida are considered most vulnerable to a housing downturn. Virginia had eight of the least-at-risk jurisdictions including Arlington Co, Alexandria City, Fairfax Co and Loudoun Co. This is the story of real estate ownership in the greater DC Metro area – we may lagged other regions in appreciation during the pandemic boom, but we can sleep comfortably now as many markets are facing a risky future.