Question: What do you expect from mortgage interest rates in 2022?

Answer:

Historically Low Rates

The first thing to understand about mortgage interest rates is that they are market-driven and forecasting comes with the same unpredictability as any other economic/market-based forecasting (GDP, Unemployment, Stocks, etc). So take predictions/forecasts with a grain of salt.

Higher Prices Still “Manageable”

For perspective, the chart above shows the average 30-year fixed-rate mortgage in the US since 1971. Historically low interest rates have been one of the main drivers of the rapid housing price appreciation we’ve witnessed over the last 12-18 months.

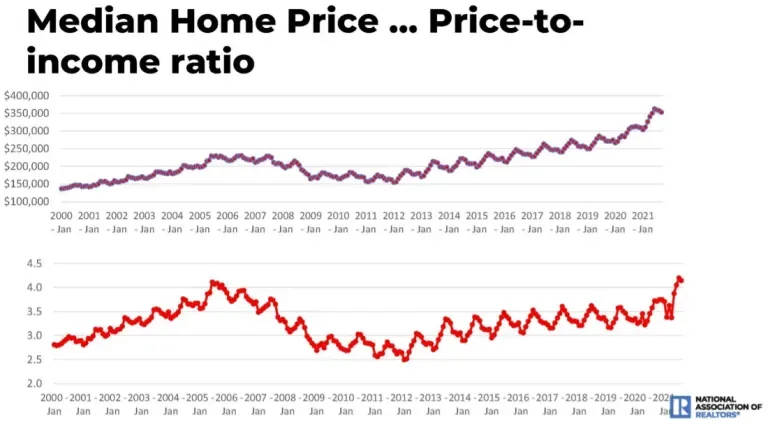

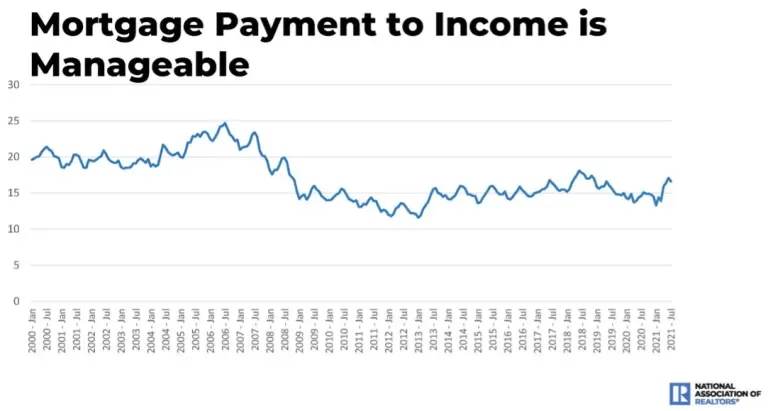

The charts below, courtesy of the National Association of Realtors, show that low-interest rates have kept affordability, based on mortgage payments vs income, lower than the ’05-’07 housing bubble despite housing prices soaring relative to income; even higher than ’05-’06 peaks.

Forecasting Future Rates

For years, we’ve been reading/hearing pundits say that it’s hard to imagine mortgage rates getting lower, often coupled with overly sales messaging from the real estate industry that you must buy now because rates have never been so low and likely will not remain this low much longer. The problem with those claims is that mortgage rates have been dropping for about 40 years now (with relatively minor fluctuations along the way)…

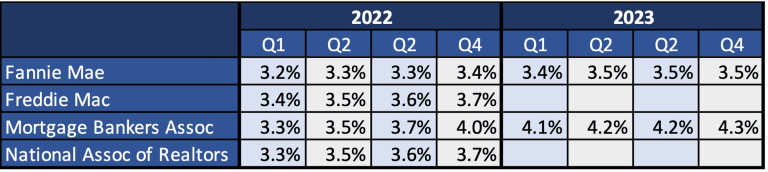

With that said, even small fluctuations in rates in the near/mid-term impact affordability and buying decisions, making forecasts for the upcoming 12-24 months relevant to those currently, or soon-to-be, active in the buyer/seller market. The chart below shows the latest 30yr fixed mortgage rate forecasts from four leading housing research sources:

Everybody expects mortgage rates to increase over the next 12-24. This is mostly based on the expectation that the Fed will start easing its economic support and will increase interest rates (indirectly influences mortgage rates) to fend off inflation, so if that strategy changes, so too will mortgage rate forecasts.

I believe that a slow, gradual increase in rates, as predicted by Fannie, Freddie, and NAR, is unlikely to have much influence on home values but any sharp increases, or even the pace predicted by MBA, could result in some downward pressure on prices. Home values are an important part of the US economy so you can expect efforts to be made by the Fed to prevent mortgage rate spikes that shock the housing market.

High Loan Limits

The Federal Housing Finance Agency (FHFA) just released new conforming loan limits for 2022, with significant increases to reflect recent price growth. The jurisdictions in the greater DC Metro area were given the maximum loan ceiling of $970,800. Beginning in 2022, Fannie/Freddie will insure loans up to $970,800 with as little as 5% down, or the equivalent of a purchase price just under $1,022,000 with 5% down. The new conforming limits increase the maximum loan amount by 3% down to $647,200, or the equivalent of a purchase price of just over $667,000 with 3% down.

For any conforming loan (or any loan for that matter), borrowers must also qualify on several factors including credit score, debt-to-income ratio, first-time buyer status, and more. Feel free to reach out to me for lender recommendations if you’d like to explore your mortgage options.

If you’d like to discuss buying, selling, investing, or renting, don’t hesitate to reach out to me at [email protected].

If you’d like a question answered in my weekly column or to discuss buying, selling, renting, or investing, please send an email to [email protected]. To read any of my older posts, visit the blog section of my website at EliResidential.com. Call me directly at (703) 539-2529.

Video summaries of some articles can be found on YouTube on the Ask Eli, Live With Jean playlist.