Question: How are you seeing recent interest rate increases affect the real estate market?

Answer: Real estate has become significantly more expensive in the last 6 weeks due to a combination of another round of strong price growth and rapidly increasing interest rates.

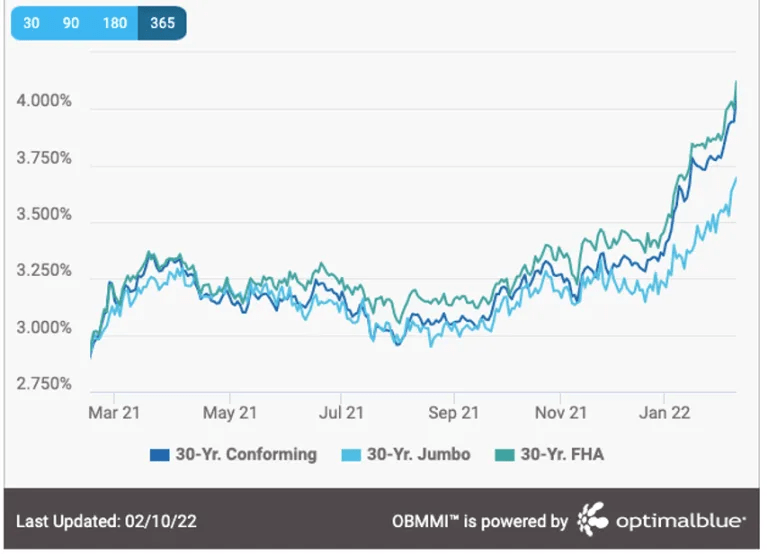

Figure 1: Average interest rates over the past year

Interest Rates Up, Prices…Up?

Theoretically, higher interest rates should put downward pressure on home prices, but over the last 4-5 weeks, as rates have been climbing, I’m seeing winning offers on single-family homes coming in 10-15% or more above the asking price (and prices justified by 2021 sales). I’ve also seen price increases and competition, to a lesser extent, in the condo market.

Why is this happening? Early rate increases seem to have had the opposite effect on prices than you’d expect because some buyers are choosing to pay more now rather than wait and risk higher rates (most projections show rates increasing through 2022). Time will tell if this gamble pays off or not.

How is this possible? We live in an area where incomes often support higher borrowing limits than buyers choose for their budgets, especially dual-income households, so many buyers, especially those with the means to purchase single-family homes, have the borrowing capacity to pay more and some are choosing to do so.

At some point, higher interest rates should cool the market, but we’ve yet to reach that point locally.

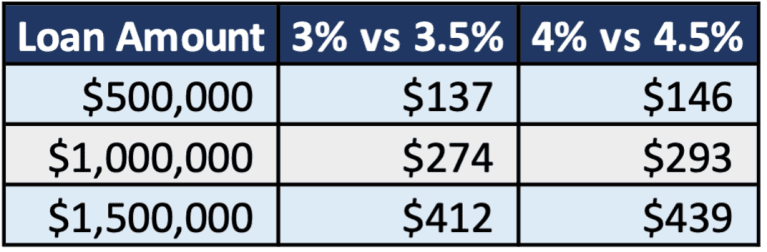

The Effect Higher Rates Have on Payments

I mentioned earlier that to this point, higher rates, and the threat of more increases in the future, have caused prices to increase. In general, a .5% increase in interest rate has a similar effect on the monthly payment as a 6.5% increase in the purchase price, so if a buyer expects interest rates to be .5% higher in a few months, they can claim a victory on their mortgage payments by paying 3-4% more now before the rate hike.

The table below is a simple reference point on how much a .5% increase in interest rate affects monthly payments at different loan amounts. Is the threat of those changes in payment enough to cause you to pay more now or make a purchase decision that you otherwise may not have?

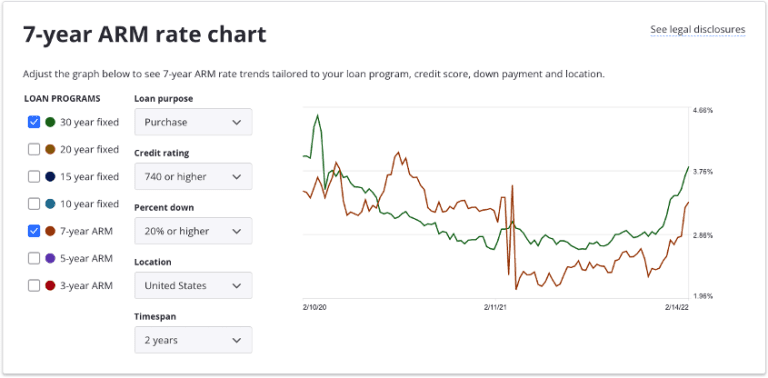

Consider an Adjustable Rate Mortgage (ARM)

Adjustable Rate Mortgages (ARMs) got a bad reputation during the Great Recession, but are worth considering for many buyers, especially those who are likely to sell within 5-10 years (that’s most buyers). For much of the past two years, the spread between ARM products and 30-year Fixed rates has been such that ARMs didn’t make sense (especially when they were more expensive than 30-year Fixed), but it’s now worth considering given the pricing of each product.

The discount of an ARM product makes sense for so many buyers because they’ll most likely sell before they reach the adjustment period (5, 7, or 10 years for most ARM products). If you think you might stay in your home beyond the adjustment period, you can also make a bet that we will re-enter a low-interest rate environment before your rate adjusts and refinance into a 30-year Fixed loan when that happens.

Figure 2: Average 30yr Fixed vs 7/1 ARM Rates, Courtesy of Zillow

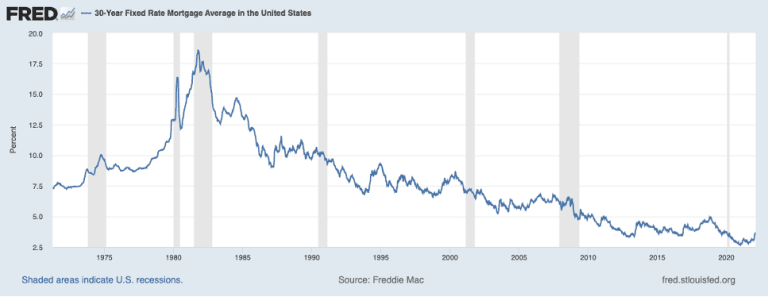

What Should You Do?

Interest rates should be a factor, not a factor, in making a housing decision. Interest rates are market-driven, and markets are volatile and unpredictable. I can’t recall a time that Fannie/Freddie, the National Association of Realtors, and the Mortgage Bankers Association have not predicted that rates would increase in the next 12-24+ months look at the chart below, we’ve had sustained rate decreases since the 1980s!

Interest rates influence buying decisions differently for each buyer, but remember that nothing will outweigh the importance of making the right housing decision and being in a home long-term so don’t let interest rate volatility change the fundamentals of your home buying (or renting) decisions.

If you’d like to discuss buying, selling, investing, or renting, don’t hesitate to reach out to me at [email protected].